tax liens in dekalb county georgia

Dekalb County GA currently has 2615 tax liens available as of July 28. Based On Circumstances You May Already Qualify For Tax Relief.

Property Taxes Throughout Dekalb Set To Rise Amid Inflation Squeeze

This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of.

. Public Property Records provide information on. Free Case Review Begin Online. Clerk of Superior Court.

Interested in a tax lien in Dekalb County GA. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Buying tax liens at auctions direct or at other sales can turn out to be awesome.

There are no tax sales scheduled at this time. See Results in Minutes. Ad See If You Qualify For IRS Fresh Start Program.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. In Georgia the County Tax Commissioners will sell Tax Deeds Hybrid to winning bidders at the Dekalb County Tax Deeds Hybrid sale. Ad Register and Subscribe now to work with legal documents online.

Find the best deals on the market in Dekalb County GA and buy a property up to 50 percent below market value. Register for 1 to See All Listings Online. Search the Georgia Consolidated Lien Indexes alphabetically by name.

Dekalb County GA tax liens available in GA. Cashiers Check Money Order or Attorneys Check payable to Dekalb County Clerk of Court. Is notified of the payoff amount and Petitioner provides 75 cashiers check for processing fee made payable to.

A lien is a legal claim to secure a debt and may encumber real or personal property. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Process to purchase an unredeemed unforeclosed tax property.

I am looking to start buying tax lien properties in Georgia. In fact the rate of return on property tax liens investments in. Property Tax Online Payment Forms Accepted.

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. PdfFiller allows users to edit sign fill and share all type of documents online. However Georgia has many tax deed sales.

Ad Property Liens Info. Buy Tax Delinquent Homes and Save Up to 50. A state tax lien also known as a state tax execution is recorded with one or more Clerks of Superior.

SPLOST Information. You have a 12 month period to save up the. For individuals enter last name first name Display Results From optional.

Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. Dekalb County GA currently has 92 tax liens available as of January 20. How does a tax lien sale work.

Plat copies are 200 per page. Dekalb County Georgia Delinquent Tax Sale. Free Tax Lien Course Reveals Major Benefits To Investment Strategy.

As of September 23 Dekalb County GA shows 89 tax liens. See Available Property Records Liens Owner Info More. TD PROPERTY INVESTMENT LLC.

Log In to CV360. Search all the latest Georgia tax liens available. Georgia does not sell tax lien certificates.

Ad See If You Qualify For IRS Fresh Start Program. I went to the courthouse a couple of months ago on the first Tuesday and it was a zoo. DeKalb County Property Records are real estate documents that contain information related to real property in DeKalb County Georgia.

You can file your mechanic liens in person at the DeKalb County Clerk of Superior Court Real Estate Division located at. September 2022 Tax Sale as of 7282022. Shop around and act fast on a new.

There are no tax sales scheduled at this time. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership. September 2022 Tax Sale as of 7262022.

Ad Find Tax Lien Property Under Market Value in Georgia. The process is a little more complicated than in some states. Based On Circumstances You May Already Qualify For Tax Relief.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. When a Dekalb County GA tax lien is issued for. Enter Any Address Receive a Comprehensive Property Report.

15 043 05 010. In return they get the property tax lien which gives them the ability to foreclose on you and take the title in 12 months in Georgia. There are more than 7306 tax liens currently on the market.

Search Information On Liens Possible Owners Location Estimated Value Comps More. I am looking to start buying tax lien. Free Case Review Begin Online.

2320 ROLLING ROCK DR. Jail and Inmate Information. Search Any Address 2.

All Cobb County Tax Lien Sales take. In Georgia tax deed sales have a. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Tax Sale Listing Dekalb Tax Commissioner

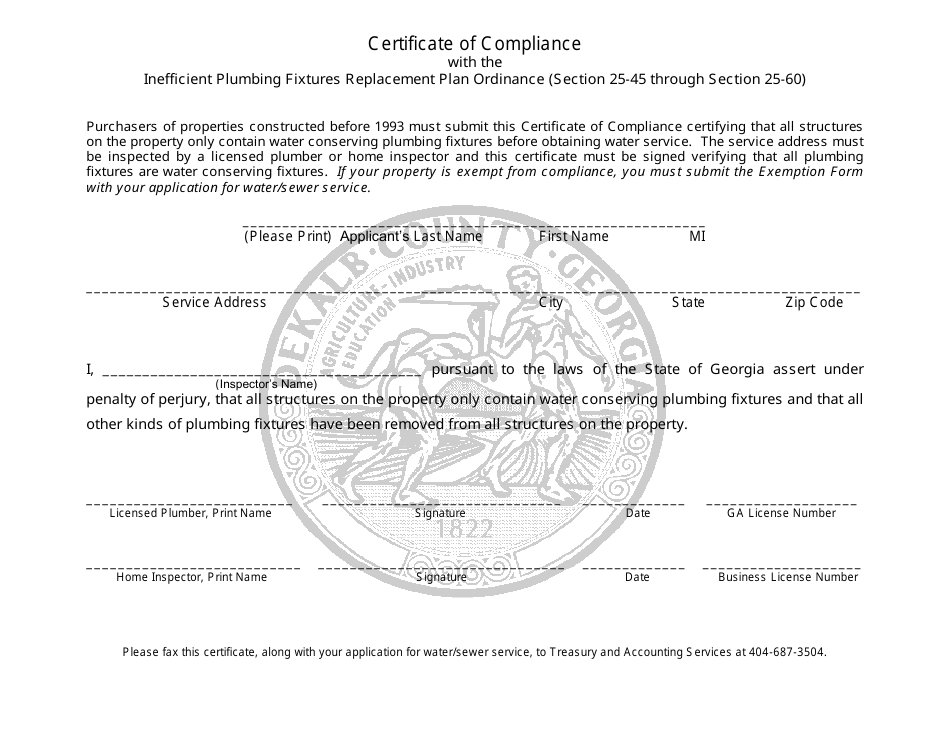

Dekalb County Georgia United States Certificate Of Compliance With The Inefficient Plumbing Fixtures Replacement Plan Ordinance Section 25 45 Through Section 25 60 Download Printable Pdf Templateroller

Southwest Dekalb High School Where My Older Brothers And All My Elementary School Friends Went Dekalb Decatur Nostalgia

Dekalb County Ga Property Data Real Estate Comps Statistics Reports

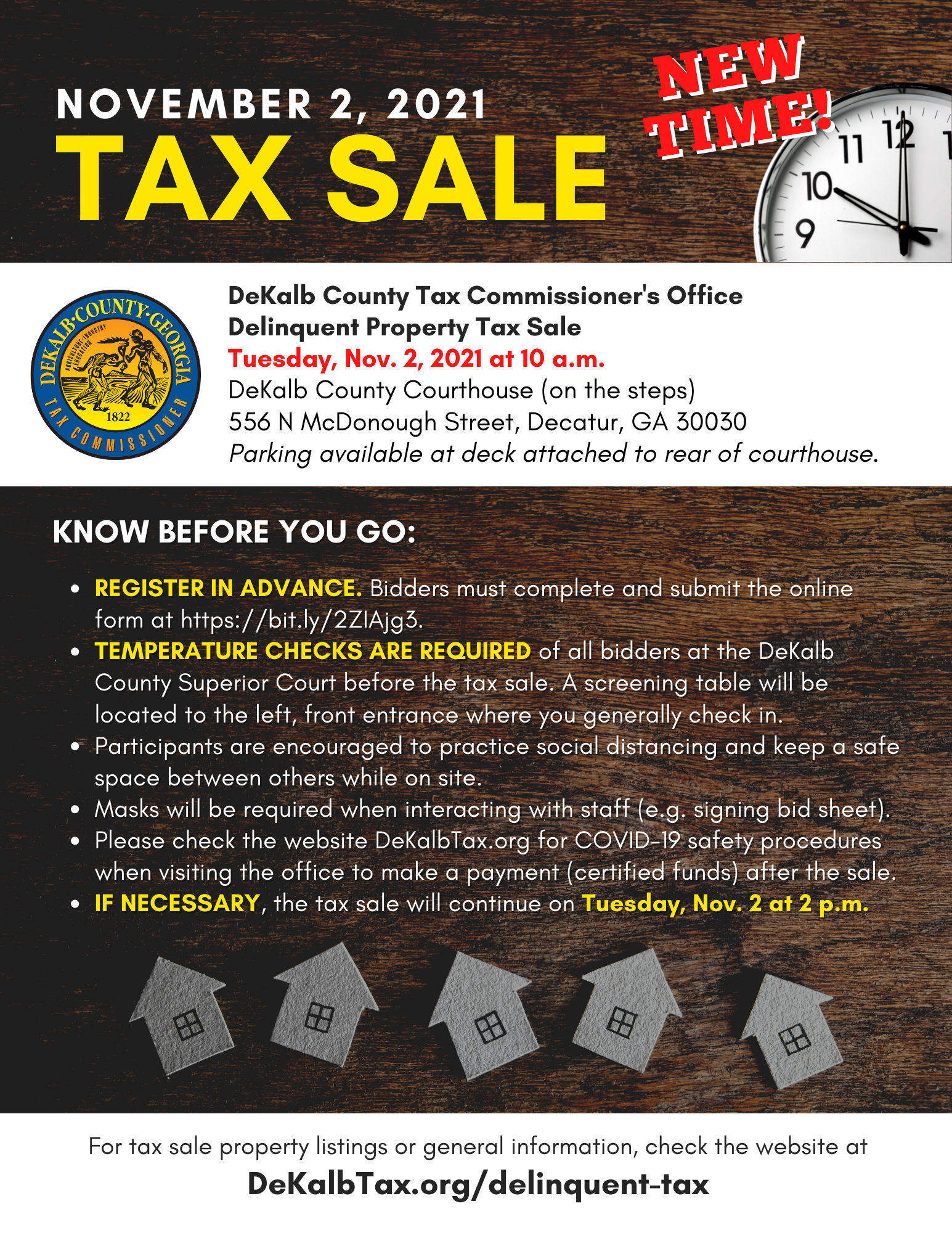

Tax Sale New Time Dekalb Tax Commissioner

![]()

Business And Alcohol License Dekalb County Ga

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Tax Sale Listing Dekalb Tax Commissioner

Tax Sale Listing Dekalb Tax Commissioner

Fill Free Fillable Georgia Gov Pdf Forms

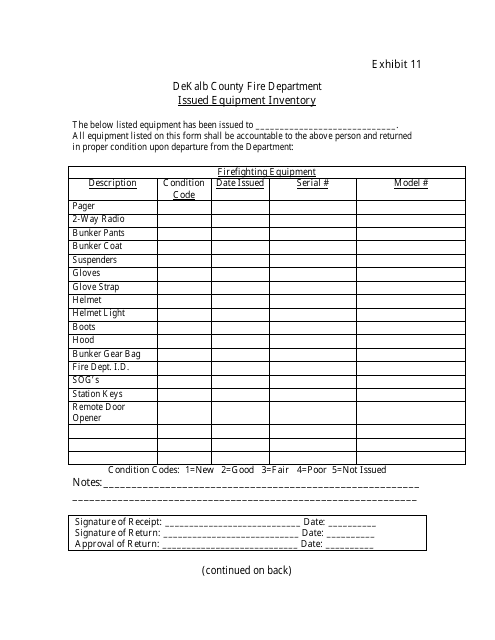

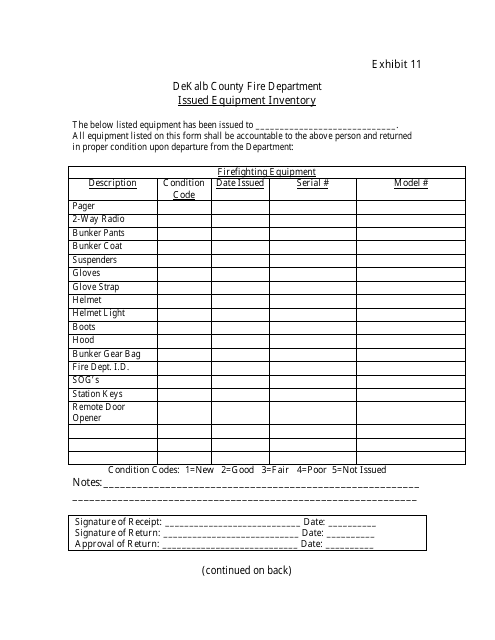

Exhibit 11 Download Printable Pdf Or Fill Online Issued Equipment Inventory Dekalb County Georgia United States Templateroller

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Small Town Usa Downtown Douglasville My Home Town Small Towns Usa Small Towns Douglasville

Tax Sale Listing Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Georgia Property Tax Liens Breyer Home Buyers

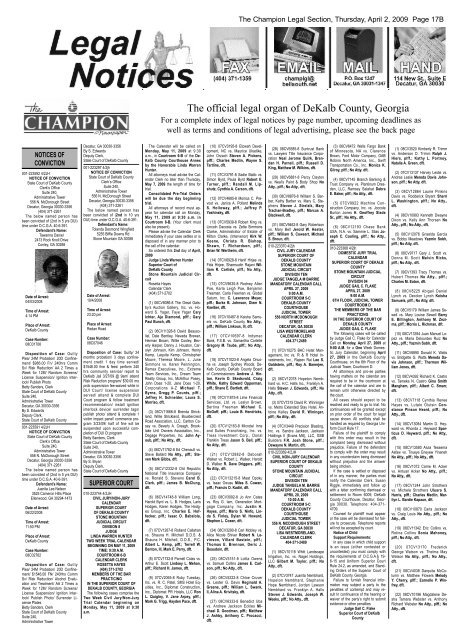

The Official Legal Organ Of Dekalb County Georgia Atlanta Goodlife